Navigating the Impact of New U.S. Tariffs on Cross-Border E-Commerce

In April 2025, the U.S. administration introduced significant changes to its tariff policies, notably affecting cross-border e-commerce.

Key Changes:

Elimination of De Minimis Exemption: Effective May 2, 2025, the previous exemption allowing shipments valued under $800 to enter the U.S. duty-free has been removed. This change directly impacts e-commerce platforms that previously benefited from this loophole.

Increased Tariff Rates: The new executive order raises tariffs on Chinese imports, with duties on low-value shipments escalating from 30% to 90%. Additionally, per-item postal fees have surged from $25 to $75, with plans for further increases.

Implications for Cross-Border E-Commerce:

Cost Implications: E-commerce platforms like Shein and Temu, which heavily relied on the de minimis exemption, now face higher costs. These costs are likely to be passed on to consumers, resulting in increased prices for a wide range of products, including apparel, electronics, and household items.

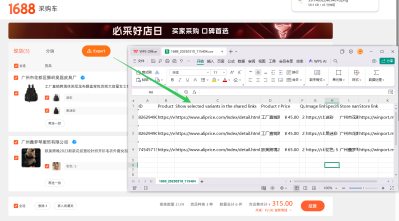

Operational Challenges: The removal of the exemption and the imposition of higher tariffs necessitate significant adjustments in supply chain management. E-commerce businesses must reassess pricing strategies, explore alternative sourcing options, and enhance customs compliance procedures to navigate the evolving regulatory landscape.

Strategic Recommendations:

Diversify Supply Chains: To mitigate risks associated with U.S. tariffs, businesses should consider sourcing products from countries not subject to similar duties, thereby maintaining competitive pricing.

Enhance Customs Compliance: Investing in robust customs compliance systems is crucial to ensure accurate tariff classifications and timely payment of duties, minimizing delays and potential penalties.

Engage with Trade Experts: Consulting with trade compliance experts can provide valuable insights into navigating the complex tariff structures and identifying opportunities for duty mitigation.

Log in or sign up to post a question